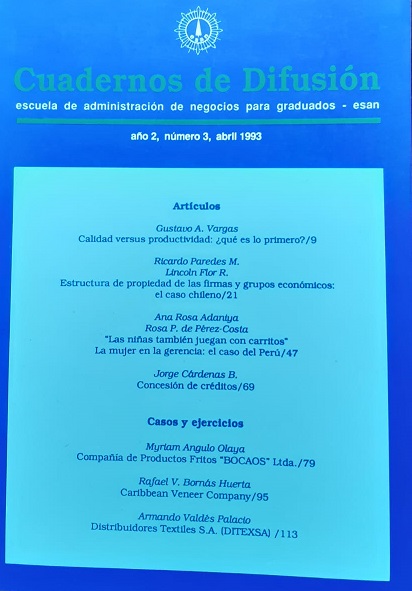

ESTRUCTURA DE PROPIEDAD DE LAS FIRMAS Y GRUPOS ECONÓMICOS El caso Chileno

DOI:

https://doi.org/10.46631/jefas.1993.n3.02Keywords:

ownership structure, economic group, regulationAbstract

It analyzes the ownership structure of Chilean firms and the effect that conglomerates or economic groups produce on this structure. The central hypothesis is that the ownership structure of firms owned or controlled by economic groups is not significantly different from the ownership structure of any other firm. The variables analyzed were ownership structure, optimal size of the firm, potential control, regulation, economic group and tradability of the good or productive sector. The most relevant finding is the evidence that the ownership structure of the firms belonging to economic groups is significantly different (more concentrated) from that of the rest of the firms in the sample, which would indicate that the firms belonging to groups do not maximize benefits individually, but as a whole.

Downloads

References

BARANDIARAN, E., “Nuestra crisis financiera”, Estudios Públicos, Santiago de Chile, oct., 1983.

BERGSTROM, C. and RYDOVIST, K., "The determinants of corporate ownership: an empirical

study on swedish data”, Journal of Barking and Finance, 14 (2/3): 237-253, 1900.

DE LA CUADRA, S, and VALDES, S., Myths and facts about financial liberalization in Chile: 1974-1982, Instituto de Economía, Pontificia Universidad Católica de Chile. Documento de Trabajo N° 128, 1989.

DEMSETZ, H., “The structure of ownership and the theory of the firm”, Journal of Law and Economics, 26: 375-390, Jun., 1983,

DEMSETZ, A., and LEHN, K., “The structure of corporate ownership: causes and consequences”, Journal of Political Economy, 93 (6): 1155-1177, Dec., 1985.

GERSON, J. and BARR, G., The determinants of corporate ownership and control in Souh Africa, UCLA, Working Paper, 1991.

GREGORIE, J., “Estimación de betas accionanios”, Paradigmas en Administración, Santiago de Chile, (8), 1er sem, 1986.

HOLMSTROM, B., “Moral hazard and observability”, Bell Journal of Economics, 10(1): 74.91, Spring, 1979.

Moral hazard in teams, Bell Journal of Economics, 13 (2) 324-340, Autumn, 1982.

JENSEN, M., “Agency cost of free cash flow, corporate finance and takeovers”, American Economic Review, 76 (2): 323- 329, May., 1986.

“Takeovers: their causes and consequences”, Journal of Economic Perspectives, 2 (1): 21-48, Winter, 1988.

JENSEN, M. and MECKLING, W,, “Theory ol the firm: managerial behavior, agency cost and ownership structure”, Journal of Financial Economics, 3: 305-360, 1976.

MIRRLEES, J.,“The optimal structure of incentives and authority within and organization”, Bell Journal of Economics, 7 (1): 105-131, Spring, 1976.

PAREDES, R., Economics groups in less developed countries, UCLA, 1989, Mimeo.

Causas de los grupos económicos en Chile, Departamento de Economía, Universidad de Chile, 1992, Mimeo.

PAREDES, R., y GUERRERO. H.. Teoría de agencia, Universidad de Chile, 1990, Mimeo (material docente).

SANFUENTES, A., "Los grupos económicos; control y políticas”, Colección Estudios CIEPLAN, (15): 131-170, dic, 1984.

SUPERINTENDENCIA DE VALORES Y SEGUROS, "Análisis financiero de una muestra de empresas 1990", Revista Valores, Santiago de Chile, 1990.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2021 Journal of Economics, Finance and Administrative Science

This work is licensed under a Creative Commons Attribution 4.0 International License.