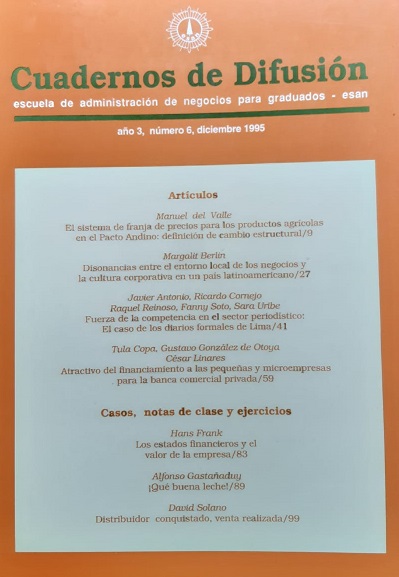

LOS ESTADOS FINANCIEROS Y EL VALOR DE LA EMPRESA

DOI:

https://doi.org/10.46631/jefas.1995.n6.05Keywords:

financial statements, value of a company, accounting principles, present value of projected cash flowAbstract

Starting from this case study, the aim is to demonstrate the reasons why financial statements cannot be taken as a good basis for determining the value of a going concern. To do this, the valuation method based on the adjusted book value is explained, in which the accounts from which the adjustment needs for differences arise most should be carefully reviewed when applying valuation criteria: marketable securities and investments, accounts for collect, inventories, fixed assets, intangible values and liabilities. It is also the value of the going concern, for which, in addition to the assets accounted for, intangible values are considered: market, brand, business location, know-how, managerial capacity and operating systems. Finally, the method of the value of the return or based on the profit potential is presented, very widespread in the valuation of companies in progress and which consists of determining the current value of the projected cash flow.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2021 Journal of Economics, Finance and Administrative Science

This work is licensed under a Creative Commons Attribution 4.0 International License.